Saving money doesn't always easy, but it's essential for achieving your financial goals. By implementing a few simple strategies, you can maximize your savings potential and get yourself up for a secure future. , Starting with, create a realistic budget that tracks your income and expenses. This will enable you to identify areas where you can cut spending and redirect more funds towards savings.

Furthermore, research different saving options, such as high-yield savings accounts, certificates of deposit (CDs), or money market accounts. These options typically give higher interest rates than traditional savings accounts, enabling your money to grow faster.

Furthermore, establish a savings objective and commit to it. Having a clear goal in mind will motivate you to save consistently. In conclusion, remember that saving is a continuous process. Even small, consistent contributions can grow over time and make a substantial difference in your financial well-being.

Frugal Living Hacks You Need to Know!

Are your wallet ready to become a money-saving superstar? It's time to ditch those pricey habits and embrace clever strategies that will have your bank account dancing. First, let's tackle your hidden costs in your budget. Track how you spend for a month and identify sections where you can cut back. Consider doing lunch instead of eating out, which can majorly impacts your savings. Don't forget to shop around before making spending sprees. There are always better options out there if you put in the effort.

- Additionally, remember to negotiate bills with service providers. You might be surprised at what you can reduce.

- Finally, don't forget the power of patience gratification. Resist temptation and think it over before making any luxury acquisitions.

Overcome Inflation with Smart Spending Habits

Inflation can drastically impact your finances, making it harder to attain your financial goals. But don't worry! By implementing a few smart spending habits, you can successfully counter the effects of inflation and preserve your purchasing power.

Start by creating a detailed budget that tracks your income and expenses. Pinpoint areas where you can reduce spending without compromising your quality of life. Explore alternatives to high-priced savvy savings videos items or services.

Next, emphasize saving and investing. Even small contributions can build over time, helping you endure economic downturns. Research different investment options to find fitting ones that align with your appetite for risk.

Finally, stay updated about current economic conditions and adjust your spending habits as needed. By staying proactive and implementing these smart spending practices, you can successfully conquer inflation and protect your financial future.

Master Your Finances: A Guide to Savvy Saving

Take command of your financial future by embracing the practice of savvy saving. It's not about sacrificing everything you enjoy, but rather adopting wise choices that optimize your savings potential. By developing a budget, identifying areas where you can trim expenses, and establishing clear savings goals, you can transition your financial situation from fragile to solid. Remember, every dollar saved is a step closer to achieving your goals.

Here are some fundamental tips to get you started:

* Rank your spending and identify areas where you can reduce expenses.

* Establish a realistic budget that assigns funds for both needs and wants.

* Set specific, trackable savings objectives to stay driven.

* Investigate different savings alternatives like high-yield savings accounts or certificates of deposit.

* Automate your savings by setting up regular deposits from your checking to savings account.

By putting into practice these tactics, you can master your finances and pave the way for a secure future.

Level Up Your Savings Game: Expert Tips & Tricks

Ready to dominate your financial goals? It's time to amplify your savings game! Whether you're aiming for a dream vacation, a down payment on a home, or simply want to build a solid financial cushion, these expert tips and tricks will help you reach your goals.

- Start small

- Automate your savings

- Maximize your returns

- Cut back on wants

- Negotiate bills

With a little commitment, you can revolutionize your savings habits and pave the way to a brighter financial future. Get started today and watch your savings multiply!

From Paycheck to Piggy Bank: Your Journey to Financial Freedom

Tired of living paycheck to paycheck? It's time to take control of your finances and pave the way to lasting financial freedom. This journey is not about overnight riches, but rather a gradual shift in mindset and habit. Start by monitoring your spending, creating a budget that fits your needs, and setting realistic targets. Remember, every small step you take brings you closer to achieving your dreams.

- One powerful tool is automating your savings – set up regular transfers from your checking to your savings account.

- Investing your money wisely can help it expand over time.

- Don’t be afraid to seek expert advice from a financial advisor who can assist you on your path to success.

Financial freedom is within reach. Take the first step today and begin building a brighter financial future for yourself.

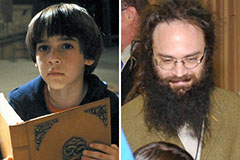

Barret Oliver Then & Now!

Barret Oliver Then & Now! Andrea Barber Then & Now!

Andrea Barber Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!